October 6, 2025

Gaithersburg, MD--Nearly every homeowner who has ever purchased a home and borrowed money from a mortgage company or bank has likely received a notice that their loan has been sold and that future payments must be sent to a new company. This notice can be somewhat concerning, especially for first time buyers, because it raises so many questions. Is this legitimate? Can they change my interest rate? I want to work with my local loan officer friend at my local bank, and not some company halfway across the country with a 1-800 phone number. Are they allowed to do that? And why would they sell the loan?

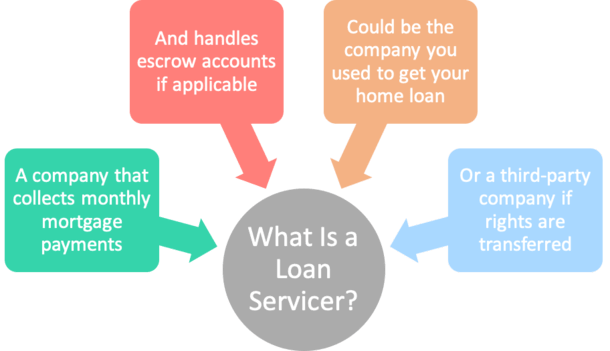

The short answer is that operating as a mortgage lender who helps someone obtain a loan is a regular money-making business. Likewise, so is running a company involved with buying and selling loans, and so, too, is the process of collecting payments (servicing the loan). Different companies are involved in various stages of the process, but in the end, like any other business, the mortgage world is made up of many entities that participate in the process and depending upon their role, they make money just like any other business.

It is important to understand the loan process and why so many entities are involved. The very short answer is that companies that lend money (which could be a mortgage broker, banker, a traditional bank or a credit union) for the purchase of a house do not have an endless supply of money to lend. Thus, they may lend money to many homeowners, but eventually they don’t have any more money to lend. Therefore, the lender will sell the loan to an investor, thus replenishing the available cash for the original lender to loan money to another homebuyer.

Often, the buyer of the loan is a Government Sponsored Enterprise such as Fannie Mae or Freddie Mac. The mortgage buyers could also be made up of a group of private investors and often they bundle mortgages into packages so that individuals can essentially “invest” in mortgages. The theory behind this is that mortgages offer a fairly safe, consistent rate of interest or return for the investors and many people are attracted to this investing option.

Also, some companies serve as the servicing company, where they collect the payments on behalf of the lender. The servicing company makes money on servicing fees and also earns interest on the tax and insurance escrow accounts. Also, the servicing company may sell related products, such as insurance or other financial products. Another big benefit for the servicer is that they are often the first contact when a borrower is interested in refinancing their loan.

Recently, we have seen some consolidation in the mortgage industry where some companies originate the loan and also have a servicing branch in their business operation. Then, when a customer indicates that they may want to refinance their loan, they are immediately connected with the loan origination part of the company. This helps the company to keep their customers in-house, so to speak, and the company continues to benefit financially from the relationship.

For the homeowner, there are certain Federal laws that help protect the homeowner from fraud or mortgage servicing scams. One very important law is what is often referred to as the “hello and goodbye” letters law. The law requires the current mortgage company to notify the homeowner that the loan is being sold, who it is being sold to, the contact information for the new company who is going to buy or service the loan and when the transfer will take place. That is the goodbye letter. Then, the new lender/servicer is required to send the hello letter. The information in that letter should match the information in the goodbye letter, and should include loan numbers, the transfer date, the contact information and where the new payments will be sent.

If the hello letter and the goodbye letter do not match, the homeowner should immediately contact a known source (such as the original lender/loan officer) and confirm that the transfer of the loan really is taking place. This is important because there are many fraudsters who attempt to fool people into thinking that their loan has been sold.

Also, the new servicer cannot change the loan terms. When the borrower signed the Promissory Note at settlement, it was the equivalent of signing a contract, with the interest rate, payment date, loan term, etc., all being agreed to in that Note. The new servicers cannot unilaterally change the interest rate or any other term, other then where the loan payments are to be sent and who the payment check is made out to.

The classic scam arises when the fraudsters look in the public land records and see that a new mortgage or Deed of Trust has been filed. These documents tell the fraudster who the borrower is, who the lender is, the property address and the date of the loan. This is enough information for a fraudster to write to the homeowner and make it seem as if the fraudster really did buy the loan. They may state that all future payments should be sent to Fred’s Bank. If the fraudster sends out thousands of letters and gets one hundred people to send in their mortgage payment to Fred’s Bank, then the fraudster can take off with the money and never be seen or heard from again. Until they send their next batch of letters, claiming to be Joe’s Bank.

This is why it is very important for homeowners to understand that the sale or transfer of mortgage loans is perfectly normal, and rather routine. But in today’s world of artificial intelligence, the ease of which creating phony documents can be completed and the general distractions of life, it is even more important that homeowners are very cautious about who they send their payments to, and particularly sensitive to any correspondence that purports to transfer a loan.

David Parker is an attorney and the Managing Director of Village Settlements-an Atlantic Closing and Escrow Company. His columns have appeared regularly in local newspapers, magazines, and newsletters. He is the co-author of the book, “Real Estate Practice in DC, Maryland and Virginia.” If you have a topic that you would like him to write about, he can be reached at dparker@villagesettlements.com

< Back